This blog was written during the summers of 2020 amidst an international lockdown during the Coronavirus pandemic. At the time of this writing, I am a Third-year Mathematics and Computing student at the Indian Institute of Technology, Kharagpur. I am also currently six weeks into my internship at Symphony Fintech, which has been my first ever experience as a professional Software Developer. In this series of articles, I will be reflecting on my experiences during my 8-week work-from-home internship, the work that I’ve done during this time, and the value it brings to the users. This series of blogs will be interesting especially for stock market analysts, beginners in the field of trading, Evolutionary computing enthusiasts, Optimization analysts, developers looking for a one-stop library for their Trading software, coding enthusiasts, and pretty much anyone wanting to go through some intriguing implementations of trading algorithms.

The unexpected emergence of Covid-19 meant I had to travel back to my hometown amidst an ongoing semester and simply pass my time since the academic activities were suspended until the whole world longed for some clarity over the entire situation. Away from the much-celebrated chaos of the hostel life and the various perks of a college campus, here I was chilling at home with relocation syndrome sucking out the dopamine-driven impulses of doing something worthwhile. But as it is often said, “The worst times bring about the best opportunities.”, It was during this time that I happened to follow through a stock market channel throughout the day. With me googling every other alien-sounding word, for a couple of weeks, and trying to understand the underlying aspects of the Technical Analysis (majorly focusing on TA), I started to wonder how I could apply my coding skills into this area. Upon some research, I found there were tremendous opportunities for such applications in the form of algorithmic trading, etc. Luckily enough, I got in contact with one such Fintech firm Symphony Fintech for an internship opening. My first discussion was with Mr. Naveen Kumar Sir, the CTO of the organization. He very elaborately and patiently explained to me how the company thrived for providing state-of-the-art solutions to stock market analysts and making the tools helpful for people even with little to no coding experience.

Nowadays, Algorithmic Trading is not just a buzzword known only to the elite section of the market participants. Following the current trend, with the ratio of algorithmic to non-algorithmic trades jumping from 0.1 to 1 within a span of the last ten years, there is no doubt, it is here for long. Even though the policies and the regulations in India haven’t been the most favorable, this growth spurt means there is no turning around. The concept of making money in seconds with just a click hasn’t looked more realistic ever.

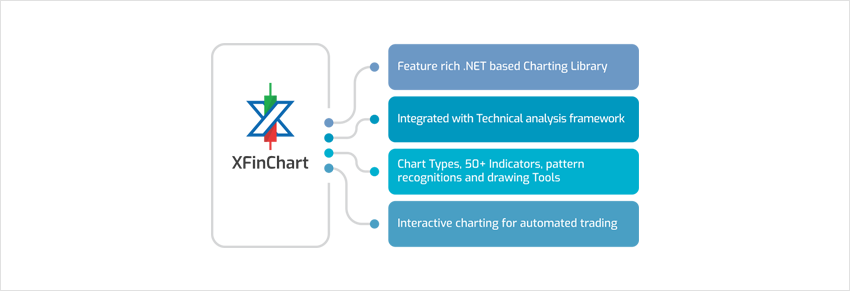

Technological advancements, especially in the improvement of processors, have had a significant role to play here too. Better clock speeds meant the users could perform more operations per second, allowing them to execute their strategies more efficiently and also make use of complex indicators that were otherwise deemed inefficient without such computation abilities. As cool as it sounds, with the data suggesting half of the trading volumes being executed algorithmically, it is to be noted that this data is w.r.t the total turnover and not the number of traders actually using it. There is still a wide gap in the market, with limited participants having access to it. A big reason is the lack of coding knowledge in a significant section of the market participants. Since the whole idea of algorithmic trading is based on the ability of the user to code their strategies efficiently, in no way can this prerequisite be completely ruled out. This is where the XFinChart library, a product from Symphony Fintech, comes to the aid.

XFinChart is a developer-friendly library built on the .NET framework for advanced stock market Data Visualization, Charting, and Technical Analysis. It also provides an inbuilt framework for creating personalized technical indicators and real-time data rendering. The library enables anyone with a basic knowledge of coding to a wide range of features wherein the user is not only allowed to make use of a plethora of in-built tools but can also customize them as per their own needs. The library has been carefully designed to provide as many options to the user as possible without any hassle of going through complex codes. During my internship tenure, I was a part of the team involved in the development of the XFinChart library.

This section was mainly focussed on giving you a little insight into the Algorithmic Trading space and a brief introduction about the XFinChart library, how it can help the user step into the field, and start making strides towards the new benchmark for trading. The next blog of this series will focus on some distinctive features of the library and how the user can use them to get significant insights into the stock market to help create a perfect strategy for your program. Following is the link to it.